These days, real estate market buzzwords are flying around like the Rolls at Lambert’s Cafe. Benchmark rates, ARMs, price volatility, basis points, seller’s market, inflation, etc.. the list goes on. If you’re looking for a comprehensive look at the real estate market as I see it – backed by personal experience and tangible research – I present to you my take on the current real estate market. (Bonus resource: clicking highlighted terms below will take you directly to the definition in my real estate glossary. Score!)

Who Wins in Today’s Market?

It’s a seller’s market, it’s a buyer’s market? I’ve been hearing for years… literally five years from my neighbor, Corey: “It’s a terrible time to buy because home prices have gone up so much”. Well yes, home prices have gone up but why do you think that is? Are you asking the right questions, Browne/ Keeley? With increased valuations homeowners also have more equity in their home than ever before in American history. Why does this matter? I will try to explain the current status of the real estate market now as a real estate professional with cited resources that shaped my opinion. So grab a glass and enjoy the read for some in-depth analysis by someone that plays in the field of real estate everyday.

Context > Headlines

The first step to understanding this market is to come to terms that today is not 2008. Bill Parcells, the two time Super Bowl winning coach, once instructed his staff to “un-prejudice yourself”. His meaning behind this phrase was to drop any preconceived notions that one may have over a player or team from last year and look at them today. Players get better and players get worse and therefore their teams get better or worse. The economy is the same way. Context changes; what caused the fall of Rome did not cause the great recession. So let’s un-prejudice ourselves from comparing this bull market run and pending demise from the great financial crisis of 2008.

Real Estate Fervor

Home prices have been hitting record highs each of the past 16 months for year-over-year growth compared to 2005. The historically low rates have put more people in a position to purchase a home than ever before. Almost everyone you know is talking about real estate in one way or another whether it’s an HGTV mania fan or your cousin at Thanksgiving talking about real estate investing. (Personally I miss Judge Judy playing in the waiting room. The verdict was so much more dramatic than the “big reveal”, which is usually just more shiplap and exposed brick features, but maybe that’s just me. Did ER doctors actually watch ER? Perhaps not. I digress.) It is easy to compare today with pre-2008 due to the hyperbolic hype and how quickly valuations have moved. But what has caused this bull run in housing and why will history not repeat itself this time? Well, there are three main factors that are large contributors to the unique circumstance we find ourselves in: Affordability, Reality, and Market Demand.

1. Affordability

Rising Mortgage Rates

The greatest impact in the real estate market over the last 12 months – and what is dominating the headlines – is Affordability. Mortgage rates have risen this year as the Fed works to combat inflation. The speed and the extent of the rising rates is what is making headlines. To combat inflation the Fed has stripped away 13 years of economic easing by moving the benchmark rate an unprecedented 300 basis points higher since the beginning of the year. The last time 30 year fixed mortgages were at 7% was March of 2002 when Dr. Phil first aired. Catch me outside, how bout dat?

How Far Does Your $$ Go?

To put this into perspective, if you were looking to buy a home in October of 2021 and you wanted to keep your monthly principal and interest payment to around $2,000 that would have put you in a position to look at homes selling for around $600,000, provided you put a 20% down payment on the purchase ($120,000). With the available rate of 7% interest today, that same $600,000 home is going to give you a monthly payment of about $3,200 before taxes and insurance. Wage growth has grown in the past 12 months nationally but not as much as inflation so that bump in pay probably doesn’t apply to your budget much if you still want to maintain that $2,000 monthly mortgage payment. Well now you’re shopping at a different store or in a different zip code altogether with the change in affordability.

Another Way to Look at It:

Assuming you still use the same down payment of $120,000 that you originally planned for with the $600,000 home purchase, you’re now shopping for a $410,000 home to maintain that monthly $2,000 payment. Woof! Feel the burn? That’s the affordability aspect and why the sky seems to be falling, but there is a broader reality as to why valuations won’t be plummeting with the deterioration of affordability.

2. Reality

Stricter Underwriting

Thanks to the Dodd Frank Act of 2010, underwriting for home mortgages has become much more scrutinized since the collapse of Lehman Brothers. Back in 2007 I probably could have gotten my dog pre-approved for a loan if I showed them his number of instagram followers (@hankhoundstl where likes equal pets). Nowadays they check and double check your income, your debt, and your employment status before agreeing to lend you those dollar dollar bills, ya’ll! And not just the day you apply for the loan, but on the day they are lending you the money you can expect your superior to receive a phone call verifying your employment. Maybe it seems a little intense, but it’s all in an effort to prevent defaults.

Different Loan Types

The biggest difference though are the loans themselves. Not only do they bear more weight in the quality of the borrowers, but they are also at fixed rates where the repayment amount doesn’t change over time. Back in the early 2000s the predominant loan programs were 2/28s and 3/27s that came with an adjustable rate mortgage. This means the interest rate would change over the course of the loan. The initial two or three years would be very low, even sub-market interest rate, but after that period your rate would adjust twice a year to the “floating rate” causing payments to balloon beyond the debtor’s ability to pay. Since then, it’s been mostly fixed rate mortgage products. Current estimates show that 90% of residential loans out there right now are at fixed rates. So while inflation affects everything from chicken wings to beer cans your monthly mortgage payment and a hotdog at Costco will remain the same this time around.

3. Market Demand, and lots of it!

Short Supply & Sharp Demand

Demand is what drives price volatility. The most conservative estimates right now say that the United States is structurally short on supply to the tune of two million units underbuilt with more aggressive assumptions reaching six million units underbuilt. Cap that with historically low interest rates and you’ll understand why home prices have taken off in the last five years: ye ole’ Supply and Demand Curve!

Historical Supply Patterns

So what will home prices look like? Here’s some more data to shake a stick at. Currently, we are seeing about four months’ worth of supply in the market. In other words, at the current pace of home sales we will be out of stock in four months if no new listings hit the market. Dating back to the 1980s what has been true is that if the market is below six months’ of supply it’s considered a seller’s market. There is more demand than there is supply to fill so prices will continue to rise. It is also historically true that whenever months of supply is below six months, home prices will continue to increase six months moving forward.

Demand Wins

This week in my real estate world I saw four, six, and nine offers on homes priced between $200,000 and $500,000 even as interest rates are breaking 7%. Which indicates that demand still seems to be holding steady; it’s not just another short lived TikTok craze.

That 70s Show?

For more historical perspective to plan your pretty picnic and predict the weather, the last time rates jumped like this was in the late 70’s. In February of 1977 30 year fixed rates were at 8.65%. Three years later by 1980 they were at 16.25%. Oil Shock! A year later on Wednesday October 21, 1981 rates hit an all time high of 18.39%. In that timespan from 1977 to 1987 the median home price in the US went up 111%. Whatchu talkin’ ‘bout Willis?! Yes, and who do we have to thank for that? It’s not president Ronald Reagan (wait, the actor?). It’s millennial babies! So are we talking Diff’rent Strokes or are we talking reality TV?

Generational Traffic Jam

Even in the early 1980s when rates jumped to over 18% on a 30 year fixed, home prices did not wane, they only continued to climb at a steady pace. So why is it that when affordability has deteriorated so much today that there is still so much demand? Well, It’s a generational fight worse than debating who played the best Batman (who we all know is Michael Keaton). Currently one in three homes in the US are owned by someone age 65 or older, mostly Boomers and the Silent Generation. Those two generations combined account for approximately 92 million people asking the 138.4 million Millennials and Gen Xers how to change their smartphone settings. Besides the technological divide between the generations, millennials today are ages 26 and up. Even the youngest of their generation is starting to “settle down” and find more stable living arrangements, like the houses that older people are still living in. Boomers and the Silent are living longer than their parents and they are doing so by living longer in their own homes than their parents did. This has been coined “aging in place”.

Now What?

So despite the headlines of the pending economic recession being correlated to the housing market I don’t see the parallel. There is a very real shortage of dwelling units for us all to live and grow in, that 2 to 4 million shortage I mentioned above. While demand will wane some from lower income households being affected the most by affordability, it doesn’t quite usurp the overall demand for housing in this country or the continued lack of inventory moving forward. If anything it seems more plausible that it will only exacerbate the issue of low inventory. So what can we do about supply? Well, with rising rates owners may be less ambitious to sell their home due to the lower affordability in purchasing a new one. Builders are also hesitant to keep building as they see their margins diminish. In the trailing 12 months single family unit new construction starts (when they break ground) are only back to 1997 levels; this is well below its peak in 2006.

Priorities Evolve, Demand Stays Steady

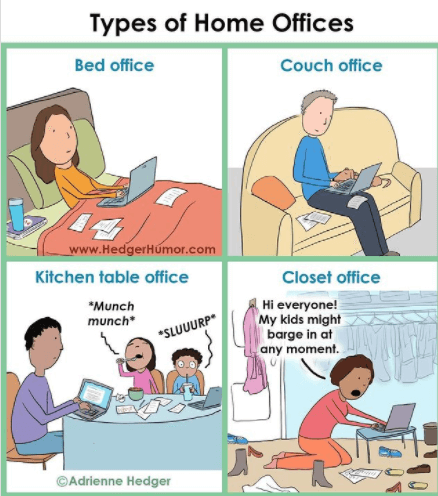

So how much demand can possibly wane when we are already grossly underserved structurally and we don’t see new inventory hitting the market? The answer is… I don’t have an answer. However, this is the question we should be looking into more and the answer will only come in time. Overall, there is still a strong demand for housing as Americans still desire homeownership. The pandemic has changed the priorities of homebuyers. A two bedroom one bath used to be standard starter home criteria, but with hybrid work here to stay home office space has become an essential need and not just a desk in the corner.

Outlook

I do think housing prices will stabilize to more normal appreciation rates. When you read or hear home price declines on the news they are only reporting the rate of change, e.g. home prices were up 7%, they have declined 3% = home prices are up 4%. If you’re on the coasts the changes will be more dramatic. Overall I see buyers gaining a little more leverage than they have had in some situations but I don’t see valuations falling off a cliff unless a bunch of distressed sellers hit the market. Of course, some of that will happen. In real estate you make money when you purchase, and some unrepresented or poorly represented buyers will be underwater. Others will be affected by unfortunate life events like death, divorce, job loss, or relocation. Real estate is a long term game. When it comes to life we can plan a pretty picnic but we can’t predict the weather, just like some person eating a bat, or an authoritarian playing a terrible game of Risk that disrupts our world as we know it.

Do You!

So when life does happen and you do find yourself needing to move, having a want, a need to buy, a need to sell, or for any other reason let’s have a chat! We can do the math and create a strategy that makes sense for you and your situation. But if you’re trying to time the market for when is the “best time to buy”… Honestly, it was probably five years ago, Corey. But today is not five years ago. One of my favorite quotes is by Gary Shilling: “The market can stay irrational longer than you can stay solvent”. My take on it? Do what is best for you. Don’t be hampered by tickers, headlines, and click bait. The timing of your life and needs aren’t always going to align with the ebbs and flows of the market. If you have a need and the numbers make sense, let’s make a plan to move your life forward.

Resources

- Gary Shilling: http://www.agaryshilling.com/a-gary-shilling

- Case-Shiller U.S. National Home Price Index: https://fred.stlouisfed.org/series/CSUSHPISA

- The FED: https://www.federalreserve.gov/faqs/about_12594.htm

- Pew Research: https://www.pewresearch.org/

- IRS: https://www.irs.gov/publications/p936

- Morgan Stanley “Thoughts On the Market” Podcast with Jim Egan: https://www.morganstanley.com/ideas/thoughts-on-the-market-us-housing

- Home of the Throwed Rolls – Lambert’s: https://www.youtube.com/watch?v=uUf0Em9_MYI

- Whatcha Talkin’ ‘bout Willis? https://www.youtube.com/watch?v=atx5i_9OnWc

Well, there you have it: the real estate market now, as I see it. Let me know if if anything surprised you, what your take is, or shoot over any other real estate questions you may have. I’m here to listen and I’m here to help however I can. Cheers!

– – –

Ryan Koppy is a local St. Louis real estate broker who acts first and foremost as a trusted guide and confidant. He helps growing families, business owners, investors and individuals with making some of the biggest financial decisions of their lives. If he’s not talking about bees, baseball, hockey or outdoor sports he’s usually discussing real estate. At the end of the day, he wants to help good people make good real estate decisions. ** Contact Us today to learn more: 314.620.5542 **